Unless the federal and or state government take action to prevent the accrual of rent arrears over the coming months, the evictions moratorium will simply end for renters in deferred evictions, on-going debt and tarnished reputations during the recovery stage. Rent reductions, where the rent due is reduced, rather than rent deferral, must be the aim.

National Cabinet turned out to be a lost opportunity. Many of the principles outlined by the Prime Minister in the mandatory code of conduct for commercial rents could have been applied to residential tenancies. National Cabinet could have pushed lenders to play their part and required broad relief from residential mortgage costs, and in particular capitalization of interest, removing a key barrier to rent reductions for tenants. Despite this, most landlords will have access to mortgage relief on the basis of economic hardship.

The issue of residential tenancies has now been left for the state government.

Reducing costs

How can we hibernate and suppress (to use the PM’s speak) the costs of rent and mortgage and keep as much money flowing around the economy as possible, rather than using income support payments to service debts and loans?

It’s clear that rents need to be reduced [1]. The average cost of rent in Australia is $400 per week and the maximum that a person relying on Jobseeker, Corona Virus supplement and full rent assistance will receive is $620 per week. If we push lessors’ costs down, rent reductions should work for all.

How could a reduced rent be set?

We want to look at what we’re calling an input based rent. What are the temporarily reducible costs and what’s unavoidable for lessors during the COVID-19 crisis. If you take out the former how much rent does a landlord need?

Queensland input based rents

To find out what an input based rent might look like in Queensland we’ve used a model developed by the Tenant’s Union of NSW. We’ve worked out the average costs incurred by Queensland landlords, reviewed the categories of costs relevant during the COVID-19 crisis, and removed those which could be relieved to come out with an input based rent amount (or call it a crisis or hibernation rent).

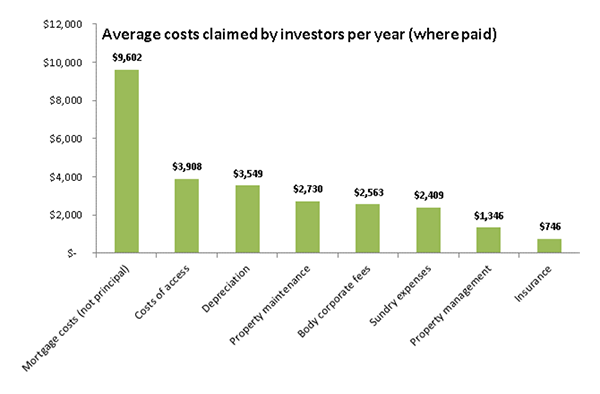

Using ATO taxation statistics, this first grafh shows the average costs faced by Queensland landlords by reviewing the most recent four years’ of claims for tax relief for rental properties. They’re then adjusted to today’s dollars and averaged out.

Average of 2014-2017 tax years, inflated to $2019

These categories include (shown from left to right in the graph above):

- Mortgage – interest on loans and borrowing expenses (not principal) (82% of investors) – includes both negatively and positively geared properties.

- Costs of access (council rates 98%, water 69%, land tax 5%)

- Depreciation (for plants and equipment 74%, for capital works 55%)

- Property maintenance (Repairs and maintenance 83%, Cleaning 15%, Gardening 17%, Pest control 20%)

- Body corporate fees (34%)

- Sundry expenses (sundry rental expenses 55%, Advertising for tenants 14%, Stationary and communication 33%, travel expenses 30%, legal fees 2%)

- Property management (76%)

- Insurance (86%)

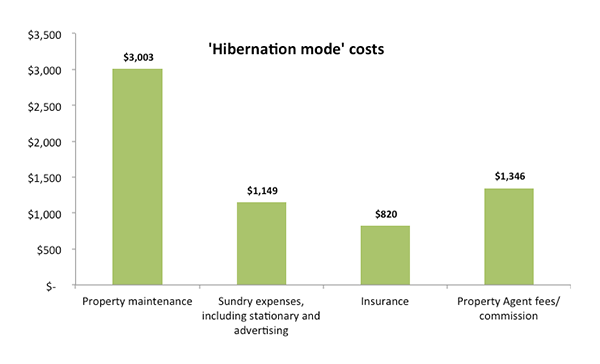

Input costs model – reducing rent to hibernation or suppression costs

Using the TUNSW theory [2], we’ve decided which lessor costs could be excluded during the COVID-19 crisis.

Removing mortgage costs which dominates outlays, and delivering relief from council rates and water charges would have significant impact and facilitate downward pressure on rents.

A number of outlays need to remain: property maintenance, agent fees, sundry expenses and insurance.

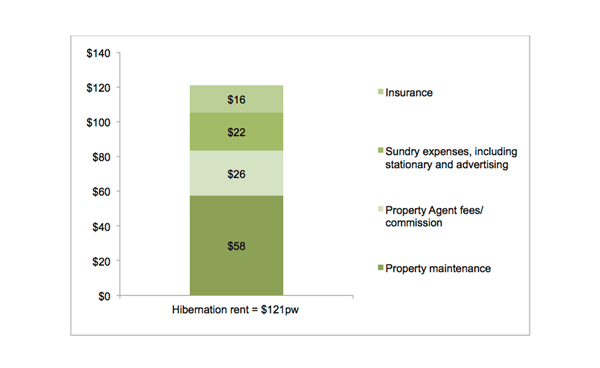

Input based rents are very affordable

The following graph show that if implemented, how much rent (on average) would be required by a Queensland landlord during our hibernation period for an input based rent. This is a very affordable rent at $121 per week

Average ‘hibernation mode’ rent = $121pw

There are obviously other ways to benchmark reduced rents. An income based model could be used where a person pays a percentage of their income, e.g. 25% of their income (Jobseeker, Corona Virus supplement rent assistance if they qualify) to a maximum of market rent (whatever that is going forward!) or a set percentage reduction such as 30 or 40%. However we set rent reductions, we need a formula which acts as an incentive to good faith negotiation by landlords and agents.

[1] The term reduced rent is used here to describe a rent which is applied during the crisis, reduced from the previously required rent. It is not a deferred rental cost. A reduced rent, if paid in full, does not accrue a rent debt.

[2] The typical property maintenance bill is $2730 per year and some level of maintenance is claimed by 83% of investors. Maintenance on their own title should have a little more expenditure because homes in strata or community titles have some maintenance costs transferred to the body corporate. This is also true of insurance costs – the building insurance in particular is held by the body corporate instead of the individual lot owner. Either way building insurance, unlike landlord insurance is required for mortgages. Only 86% of lessors claimed any type of insurance, both interesting and a bit worrying. For this reason, we’ve left out body corporate fees, and we’ve added 10% to both the property maintenance and insurance costs to ensure that the amounts are reasonable.

We’ve left in property management fees – some property management fees are for finding a new tenant (which is unnecessary for the purpose of hibernation) or weekly commissions which might reduce if the rent comes down. However we’ve left it in, because these are speculative – and the rent is still very affordable. To some degree these fees also reflects actual labour spent on managing a property – this is a cost that exists whether management of the property is managed by the owner themselves or a property.